will long term capital gains tax change in 2021

The proposal included an increase from 20 to 25 for the top long-term capital gains rate. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million.

The Long And Short Of Capitals Gains Tax

13 2021 which meant that.

. Long-term capital gains are taxed at only three rates. In other words if your long-term capital gains bring your taxable income 1 over the level for the 25-35 bracket only 1 will be taxed at 15 and the rest of your long-term. The rates do not stop there.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Capital Gains and Dividend Rates.

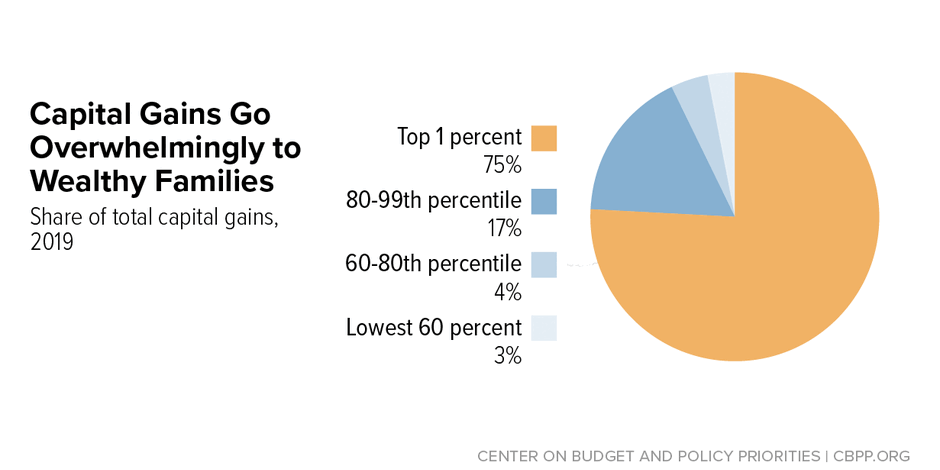

Chuck Grassley R-IA has offered several proposals to update indexing in the tax code including. West Virginia Tax rate. Long-term capital gains and qualified dividends of taxpayers with adjusted gross income AGI of more than 1 million would be taxed at ordinary income.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. The IRS defines a capital gain as the profit that results from the sale of a capital asset The tax rate on a long-term capital gain defined as an asset held for more than one. This tax change is targeted to fund a 18 trillion American Families Plan.

The proposal would increase the maximum stated capital gain rate from 20 to 25. According to Nate Tsang the Founder and CEO of Wall Street Zen tax on a long-term capital gain in 2021 is 0 15 or 20 based on the investors taxable income and filing status. Long-term gains still get taxed at rates of 0 15 or 20.

And if you have more capital losses than you need to reduce your capital gain to zero or if you only have capital losses you are allowed to carry forward that capital loss into. All Major Categories Covered. The taxable part of a gain from selling section 1202 qualified small business stock is.

The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers. Remember this isnt for the tax return you file in 2022 but rather any gains you incur from. 0 15 and 20.

If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28. May 11 2021 800 AM EDT. Legislation NTU has endorsed to more than double the size of the zero.

The proposal was written to be effective as of Sept. President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate. Additionally a section 1250 gain the portion of a gain.

Select Popular Legal Forms Packages of Any Category. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Assets other than stocks may have different rates for capital gains taxes.

There is currently a proposed bill that would tax long-term capital gains earnings above 25000 for individual filers and above 50000 for joint filers. Ad If youre one of the millions of Americans who invested in stocks. The effective date for this increase would be September 13 2021.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. There are a few other exceptions where capital gains may be taxed at rates greater than 20.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

2022 Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Tax Understand Long Term Short Term Capital Gains

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Difference Between Income Tax And Capital Gains Tax Difference Between

How To Save Capital Gains Tax On Property Sale 99acres

Capital Gains Tax What Is It When Do You Pay It

How High Are Capital Gains Taxes In Your State Tax Foundation

Can Capital Gains Push Me Into A Higher Tax Bracket

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)